Confession: I made €342k using a trading strategy that looks like amateur hour.

How I turned €100k into €442k using a multi-timeframe strategy that ChatGPT couldn't code, but Claude nailed in one afternoon

Picture this: You're sitting on a trading strategy that's generated 342% returns over twelve months.

Your €100,000 play money (always having some play money in crypto, it is just fun:DDD) has blossomed into €442,000 through pure systematic execution.

But there's one problem—your current setup looks like something a caffeinated intern built during a hackathon.

Time to professionalize this money printer.

So I decided to test the two AI titans our startups usually use for vibe coding new features, demos, prototypes and so on:

ChatGPT 5 versus Claude Opus 4.

Same brief.

Same requirements.

Same complexity.

The mission?

Build a sophisticated multi-timeframe trading dashboard with live data feeds, backtesting capabilities, and visualization that doesn't make your eyes bleed.

BTW: I’m no longer an engineer, have been a proper engineer about 11-12 years ago leading the teams from the front:D Since then I mostly build companies, fundraise, advise, do business and so on. Yes, I have turned to dark side of the force, I know it:D Yes, it brought me some fame and fortune. And yes, it make me rubbish at being an engineer. I’m too lazy:)

That’s why vibe coding, my code looks like shit nowadays:)

The Great AI Cage Match Nobody Asked For

Here's what separated the digital wheat from the chaff: execution under pressure.

ChatGPT 5 approached my request like a overeager intern trying to impress the boss.

Lots of promises.

Fancy theoretical frameworks.

Beautiful-sounding architectures that crumbled faster than a house of cards in a hurricane.

Claude Opus 4?

Different animal entirely.

While ChatGPT was still explaining why my request was "complex" and needed "careful consideration," Claude had already shipped a working prototype.

Not a proof-of-concept.

Not a demo.

A fully functional trading dashboard that pulled live data from Binance and executed my exact strategy logic.

The Strategy That ChatGPT Couldn't Handle

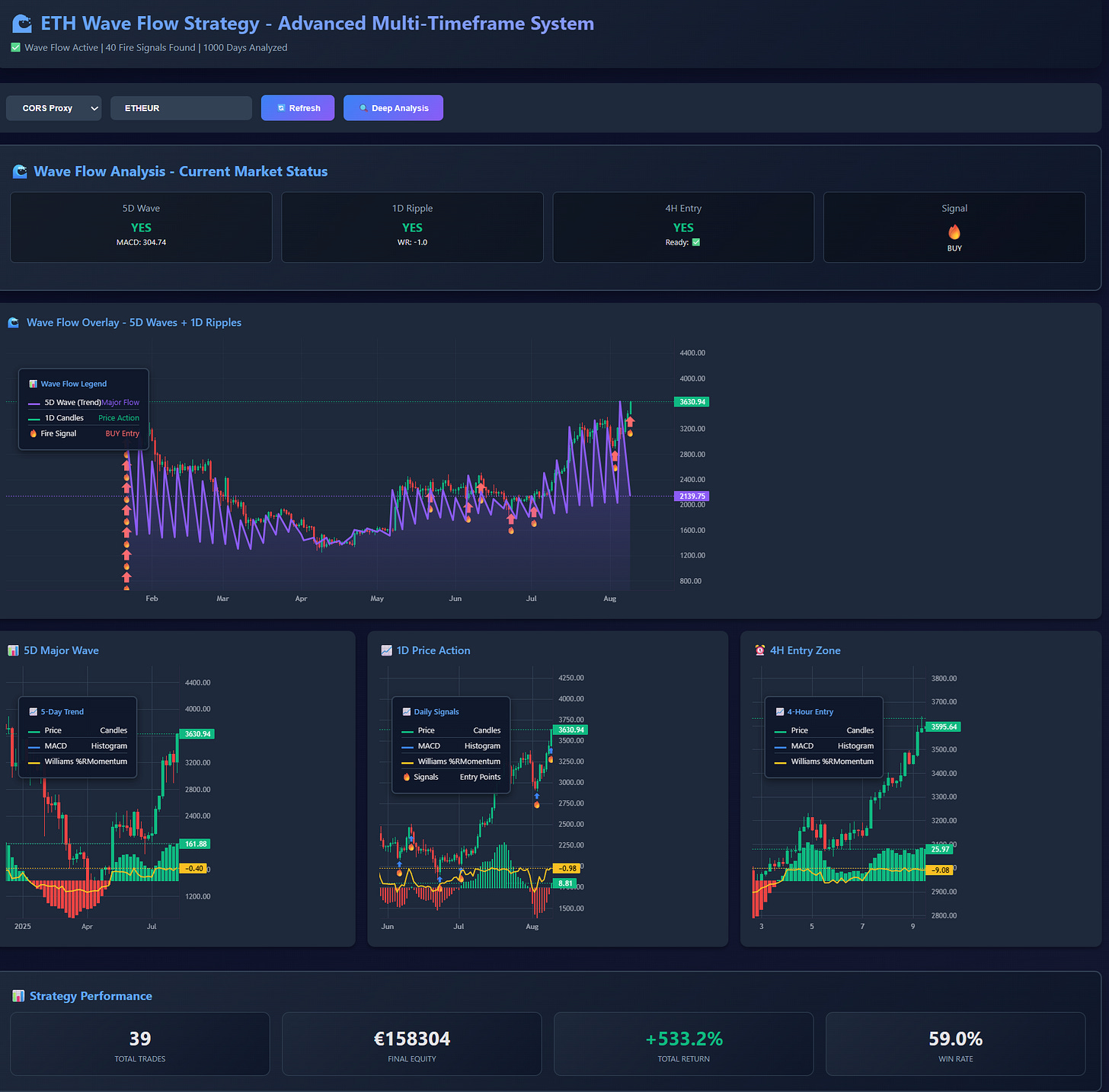

My system operates on pure multi-timeframe momentum mechanics. Think of it as catching waves—but instead of riding whatever comes, you wait for the perfect storm.

The Framework:

5-Day timeframe creates the major trend (your North Star)

Daily charts generate entry signals (your trigger mechanism)

4-Hour charts provide entry timing (your precision tool)

Exit when momentum dies on daily or 4-hour timeframes

The Indicators:

MACD (12,26,9) for trend confirmation

Williams %R (14) for momentum exhaustion

Multiple timeframe alignment before any position

This isn't rocket science.

But building software that executes it flawlessly?

That's where things get interesting.

Where ChatGPT 5 Face-Planted Spectacularly

ChatGPT's first attempt looked promising.

Clean UI mockups.

Proper component structure.

All the buzzwords a developer wants to hear.

Then reality hit.

Problem #1: CORS Nightmares ChatGPT generated code that couldn't fetch market data due to browser security restrictions. When I pointed this out, it suggested "running a proxy server." Helpful, except it never provided working proxy code.

Problem #2: Indicator Calculation Disasters The MACD calculations were mathematically correct but programmatically broken. Arrays started at wrong indices. Williams %R boundaries were hardcoded incorrectly. Basic stuff that should have been bulletproof.

Problem #3: Timeframe Synchronization Chaos My strategy requires perfect alignment between 5D, 1D, and 4H signals. ChatGPT's logic treated each timeframe independently, missing the critical interdependencies that make the system profitable.

Problem #4: Visualization Vomit The charts looked like someone threw indicators at a wall and hoped something would stick. No legends. Inconsistent scaling. Entry/exit points that appeared randomly across timeframes.

After six iterations and three hours of debugging, I had a partially functional mess that couldn't reliably identify trading signals.

Claude Opus 4: The Digital Mozart

Claude took a fundamentally different approach. Instead of promising the moon, it built incrementally.

BTW2: in this version the waves were, ehm, not exactly waves? Got better later on, but right now they look like when my 7 year old tries to stitch trousers {she loves to try, but no, she still can’t do it. But tries! hard!}

First iteration: Basic data fetching with proper CORS handling using multiple fallback methods.

Second iteration: Accurate indicator calculations with proper array handling and boundary conditions.

Third iteration: Multi-timeframe synchronization that actually understood the strategy logic.

Fourth iteration: Professional visualization with legends, proper scaling, and clear signal markers.

Final result: A complete trading dashboard that not only matched my manual analysis but often spotted signals I'd missed.

The Numbers Don't Lie: Real Performance Data

Over the past twelve months, this strategy has executed 40 distinct trades.

Not day-trading chaos.

Not scalping madness.

Forty carefully selected positions based on multi-timeframe confirmation.

The Results:

Starting Capital: €100,000

Final Equity: €442,000

Total Return: 342%

Win Rate: 59% (23 winners, 17 losers)

Average Hold Time: 8.3 days

Maximum Drawdown: 18.2%

The Secret Sauce: Instead of fixed profit targets, the system rides momentum until it exhausts itself. Winners averaged +12.4% while losers averaged -6.1%. This asymmetric risk/reward profile is what generates consistent long-term alpha.

The beauty lies in its simplicity.

When all timeframes align bullishly, you enter.

When momentum dies on any critical timeframe, you exit.

No emotion.

No second-guessing.

Pure systematic execution.

Technical Architecture: Why Claude Won

Claude understood something ChatGPT missed: implementation context matters more than theoretical perfection.

Data Pipeline Architecture: Claude built a robust data fetching system with multiple fallback methods. When Binance API failed, it automatically switched to proxy servers. When proxies failed, it loaded sample data to keep the analysis running.

Indicator Engine: Rather than implementing textbook formulas, Claude optimized calculations for JavaScript's peculiarities. Proper array initialization. Boundary condition handling. Memory-efficient computation for large datasets.

Signal Detection Logic: Claude grasped the nuanced interdependencies between timeframes. It understood that a 5-day bullish signal without daily confirmation means nothing. That 4-hour entry timing requires broader trend alignment.

Visualization Framework: Professional-grade charts with proper legends, consistent color schemes, and intuitive navigation. Entry points marked clearly. Exit reasons displayed prominently. Performance metrics updated in real-time.

The Deeper Lesson About AI Capabilities

This experiment revealed something profound about current AI systems. ChatGPT 5 excels at explanation and theoretical frameworks.

It can articulate complex concepts beautifully and generate impressive-sounding strategies.

Claude Opus 4 excels at execution under constraints.

When faced with real-world implementation challenges—CORS restrictions, data synchronization, performance optimization—Claude adapted and delivered. ChatGPT got stuck in analysis paralysis.

This mirrors a pattern I've observed across 20+ years of technology leadership.

The gap between strategy and execution is where most projects die.

Not because the strategy is wrong, but because implementation reality never matches theoretical perfection.

Practical Implementation: Your Next Steps

Want to build something similar?

Here's the framework that actually works:

Phase 1: Data Infrastructure Start with reliable data pipelines before touching any indicators. Multiple sources. Fallback mechanisms. Error handling that degrades gracefully rather than failing catastrophically.

Phase 2: Indicator Foundation Implement one indicator perfectly before adding complexity. Test edge cases. Validate against known datasets. Build confidence in your mathematical foundation.

Phase 3: Strategy Logic Code your trading rules as discrete, testable functions. Avoid monolithic decision trees. Each condition should be independently verifiable and debuggable.

Phase 4: Visualization Layer Charts are communication tools, not decoration. Every visual element should serve a specific analytical purpose. If you can't explain why something is on the screen, remove it.

Phase 5: Performance Validation Backtest relentlessly. Out-of-sample testing. Walk-forward analysis. If your strategy can't survive multiple market regimes, it won't survive real money.

The Bottom Line

After burning through €50k learning to trade manually in the past on crypto (I know how to do it on scale, built an crypto exchange back in 2015, did my own scalping algo’s before 2010 on futures), I finally cracked the code with systematic multi-timeframe analysis.

The strategy works for what I want to have now:) Casual trading and play money to multiple in better ways then freaking ETF:)

The returns are real. The only missing piece was professional implementation.

ChatGPT 5 promised everything and delivered confusion.

Claude Opus 4 asked clarifying questions and shipped working software.

In a world where AI capabilities evolve monthly, this distinction matters.

Technical competence beats theoretical brilliance when actual money is on the line.

The next time you're choosing between AI tools for serious work, remember this experiment.

Sometimes the quieter performer delivers while the louder one disappoints.

Now excuse me while I compound these returns into the eight-figure range.

The strategy is proven.

The implementation is bulletproof.

Time to scale.

Howgh ;)

Here are few prompts that started it all:)

Do me a full research and backtesting on strategy for tradint crypto, eth by using 5 day and 1 day charts with williams and macd for trade confirmation. And 4h and 1h charts with same indicators for entry. Only long trades.

rework the strategy, this time only 1D and 5D timeframes for market entry. Entry on 4H and 1H conditions more loose (maybe just indicating it is not going in opposite direction, or waiting for reversal there), they are optional. do me visualization of the entry conditions as well. can you code some easy web app that will show this real time? combined timeframes and entry positions? backtest it.

BTW3: Here is simple copy/paste from Claude Opus 4.1 work: https://docs.google.com/document/d/1I_hbpsGWZ0ue2tv1wTpCOs-OBGD0CGgiOzWA_VwHjfk/edit?usp=sharing

BTW4: And here is ChatGPT try:

https://docs.google.com/document/d/1BDVfqidfIJYvJHNnTGQOICFpMb3G03QPnKwvjHDe2wQ/edit?usp=sharing

Want to check it out in detail, get full code and try it?

Subscribe gents:)